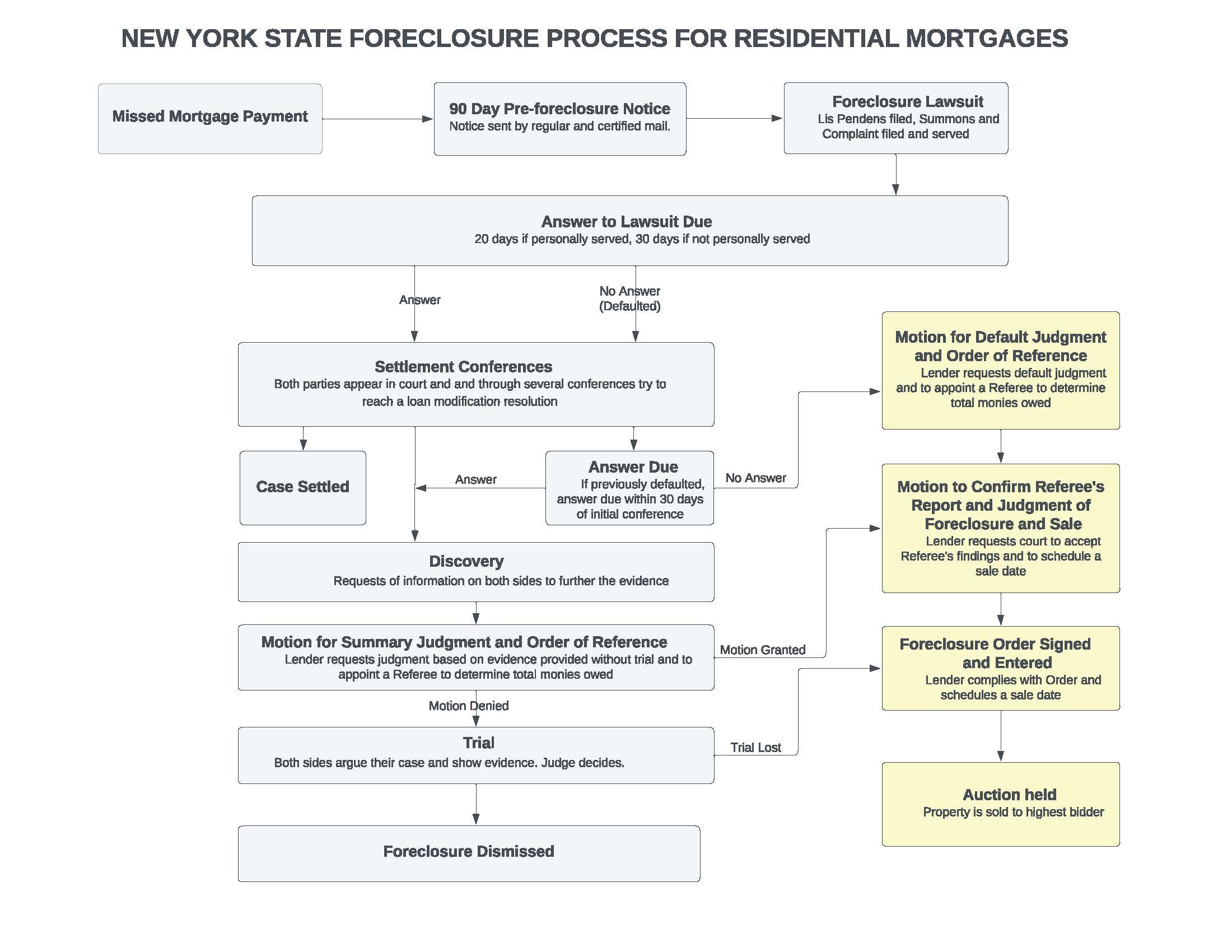

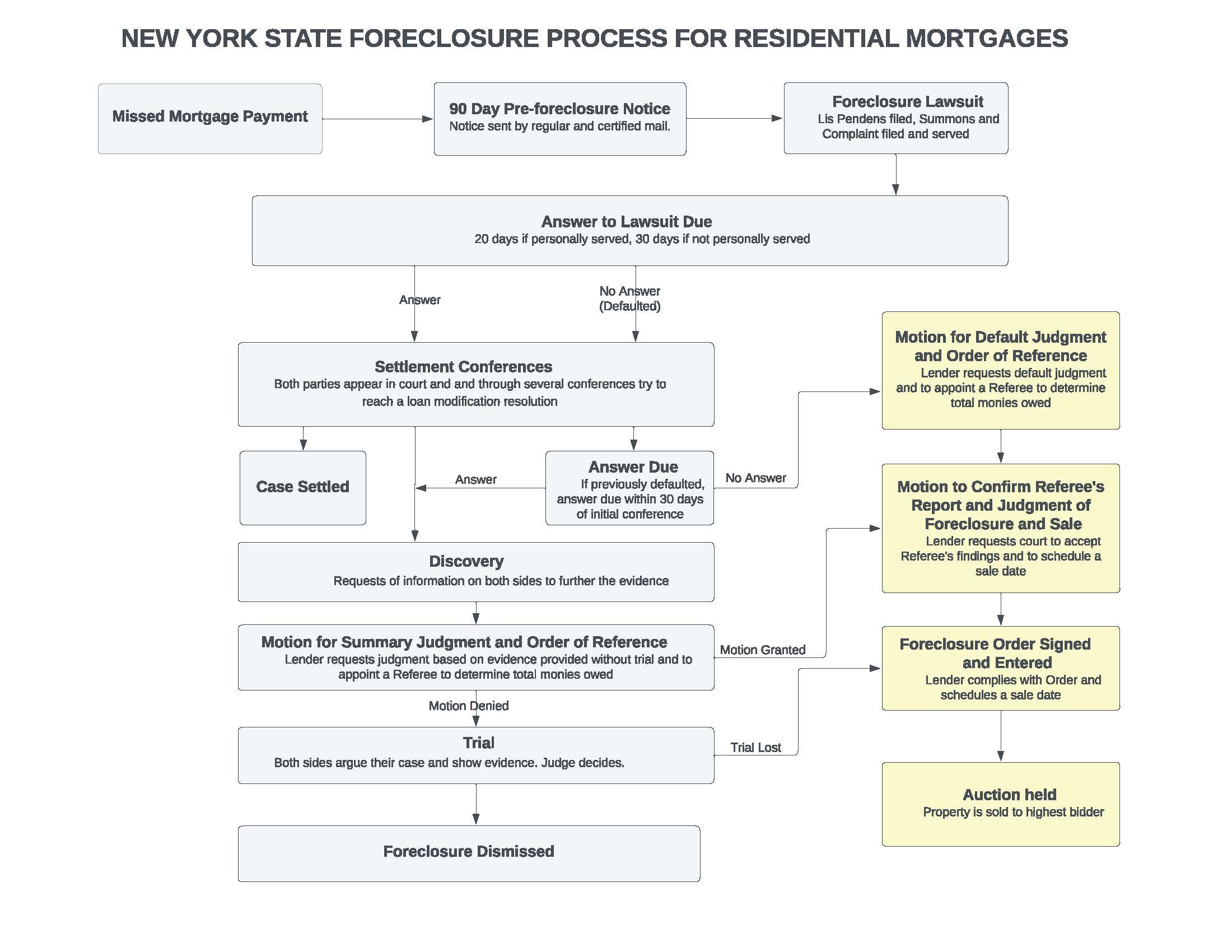

The New York Foreclosure Process

New York is a judicial foreclosure state, meaning that the lender must file and win a lawsuit to foreclose on real property. Foreclosure can be settled before the final sale through loan modification, reinstatement, pay off, a Chapter 13 to repay the arrears, deed-in lieu, private or short sale.

The length of foreclosure proceeding varies based on many factors including the merits of the case, the length of settlement conferences, and the lender’s proactivity in prosecuting, but general foreclosure actions can take up to two years to finalize before auction sale.

Step 1: Pre-foreclosure

A lender cannot initiate foreclosure proceedings with the court before 120 days have passed from the date of the first missed payment. The lender begins with a notice of default which details detailing the outstanding balance, late fees, the number of days since the first overdue payment. This notice is a preliminary step to collect past due arrears.

As per RPAPL 1304, before a lender can initiate a foreclosure lawsuit, a 90-Day notice with specific language must be sent to the borrower. The 90-Day notice must contain the following verbiage:

Any missing verbiage or extra verbiage added to the above violates RPAPL 1304 and may be grounds to dismiss a future lawsuit (Bank of America v. Kessler, 202 A.D.3d 10, 160 N.Y.S.3d 277 (2d Dep’t 2021)).

Step 2: Lis Pendens, Summons and Complaint

The lis pendens is the first step of the foreclosure process. When a borrower defaults in payment and all required notices have been sent to the borrower, the lender will file a lis pendens with the county clerk and initiate a lawsuit by serving a summons and complaint on the borrower. This lis pendens is filed as part of New York’s public records which notices parties interested in the property that there is an outstanding lawsuit against the homeowner. The summons and complaint are the actual lawsuit seeking to foreclosure on the property to secure the principal balance and arrears owed to the lender.

The lender must provide and file with the court proof that the summons and complaint notice was received by the borrower. Starting from the date of filing proof, the delinquent borrower has 20 days to respond if the summons was delivered in person, and 30 days if it was delivered by mail. Failure to respond or appear at the court-appointed date may result in a default ruling by the court in favor of the lender, which can lead to the property being foreclosed on. If the borrower chooses to respond, this response acts as the borrower’s defense as to why they have not complied with payments and is officially filed with the court.

Step 3. The settlement conference(s)

It is advisable for delinquent borrowers to attend all settlement conference accompanied by a foreclosure attorney to maximize their chances of a favorable ruling. The borrower should bring income documents to the conference to substantiate income. The outstanding loan amount, the borrower’s employment status, and reasons of default will be discussed. The judiciary will schedule a timeline of when borrower’s financial documents are due to the lender and when the lender must respond by. The lender or their representatives might be allowed to participate in this court proceeding via phone or video connection.

If the settlement conference is successful and lender and borrower reach an agreement, the lender or their representatives are legally required to drop the lawsuit by filing a discontinuation of the lawsuit.

Step 4. Discovery

The discovery process begins if no settlement is made.

If a settlement is made during the conference, then the case is over. If however a settlement can’t be agreed on, both parties will then gather information from each other during what’s called the discovery process.

During discovery, the borrower’s attorney will serve the bank’s attorney with discovery demands such as proof of the chain of title, payment history, etc.

Note that the courts in New York tend to put the onus on banks’ attorneys to certify that everything in the summons and complaint is true, and that all original documents referenced are in their possession. This can be a challenge for some lenders if the loan originated by another bank and has hence been sold or assigned several times. Savvy borrower’s attorneys could claim that the lender has no standing and doesn’t have the right to bring action if the bank wasn’t the original lender and doesn’t have the original paperwork. For example, the bank position could be compromised if it fails to provide proof of possession of the original note at commencement of the action.

Step 5: Judgments: Summary or Default Judgment, Order of Reference, and Foreclosure and Sale

Motion for summary judgment and order of reference

After the discovery process where the lender will also collect information from the borrower such as pay stubs and account statements, the lender will ask the court for a judgment without trial and for the court to appoint a referee (i.e. usually an attorney) to decide the amount owed.

Keep in mind that a summary judgment means there’s no issue of fact yet to be determined, and that this is rarely the case in real life.

Regardless, banks will submit this motion and then it can take several months to get in front of a judge and get marked as fully submitted. Note that it may also take many months to get a decision on the motion depending on the jurisdiction.

Motion for default judgment and order of reference

If the borrower doesn’t answer the summons and complaint, then the lender can ask the court for a judgment on default, and to appoint a referee (i.e. again usually an attorney) to decide on the amount the borrower owes.

Motion to confirm referee’s report and for judgment of foreclosure and sale

If the lender wins the motion for summary judgment or the motion for default judgment, then the lender asks the court to confirm the referee’s findings.

Note that it’s possible at this stage just like any other stage for the borrower to delay proceedings. At this stage, the borrower could simply challenge the referee’s report to further prolong the process.

Judge signs the judgment of foreclosure and sale

The judge signs the foreclosure judgment and orders the sale of the borrower’s home. The lender and the referee then choose an auction date at the local courthouse (i.e. typically the county courthouse’s steps).

The sale must be advertised once a week for 3 weeks in a local newspaper. The advertisement will list the property’s address and list when and where the foreclosure auction has been scheduled as well as the estimated amount owed to the lender.

Step 6. The foreclosure auction

During the final step in New York’s foreclosure process, the foreclosed property is put on sale at a public auction, usually held at the County Courthouse. Anyone can bid on the property and it is always sold to the highest bidder. Once the sale is made, the delinquent borrower loses the right of redemption and cannot regain ownership of the property by settling all arrears.

Bidding usually starts at $1,000 or at the upset price. If there is a winning bidder, they must provide a 10% down payment, with the rest of the selling price due within 30 days. Should the winning bid not close within 30 days, the buyer loses all claim to the property, as well as the full down payment.

If the bid starts at amount lower than the upset price and this is not reached, the lender can request that the property reverts back into its ownership. If this occurs, the property becomes real estate owned (REO). An interested buyer may also approach the lender or their representative after this occurs and make an offer on the property directly to the lender. This process can be less risky than an auction since a potential buyer may negotiate the terms of the sale.

Buyers interested in purchasing properties at foreclosure auctions are advised to always go through a thorough research process, to avoid unforeseen expenses or legal challenges stemming from building violations, non-paying tenants and more.

Deficiency judgment

In some cases, the outstanding mortgage debt on the property will be higher than the foreclosure sale price or the fair market value of the property. Known as deficiency, this value difference may be legally pursued by the lender in New York State, if the borrower was personally served or takes part in the lawsuit. The lender may pursue payment of the deficiency by pursuing personal judgment in court against the borrower. If the court grants the lender’s request, a deficiency judgment is entered, and the lender can collect the outstanding debt from the borrower.

Step 7. Foreclosure eviction

Following an unfavorable ruling and a foreclosure sale, the borrower will, in most cases, need to vacate the foreclosed property. This will usually happen either through a cash-for-keys agreement or eviction. If the new owner chooses a cash-for-keys approach, the former owner will be offered a financial incentive to voluntarily vacate the premises. If the former owner refuses, or the new owner doesn’t follow this approach, the new owner will most likely pursue eviction, usually through the Housing Court. Per state law, the new owner must give the former owner a 10-day notice to leave.

We provide our services in all counties of New York. You can call our office today at 718-819-1674 for a free consultation so that we can review and explain the merits of your case and develop a strategic plan specific to your needs and situation.